betterment tax loss harvesting cost

When it comes to ETF fees the race is just as tight. Ad Investing Technology Built for Low Fees to Seek Higher Returns Transparency.

Betterment Review 2022 A Robo Advisor Worth Checking Out

299 for a 60-minute financial checkup or a.

. However Betterment charges a 015 fee. Youre not in the 10 or 15 tax brackets. Tax-loss harvesting tries to improve your returns by minimizing your tax bill but it is also tedious work.

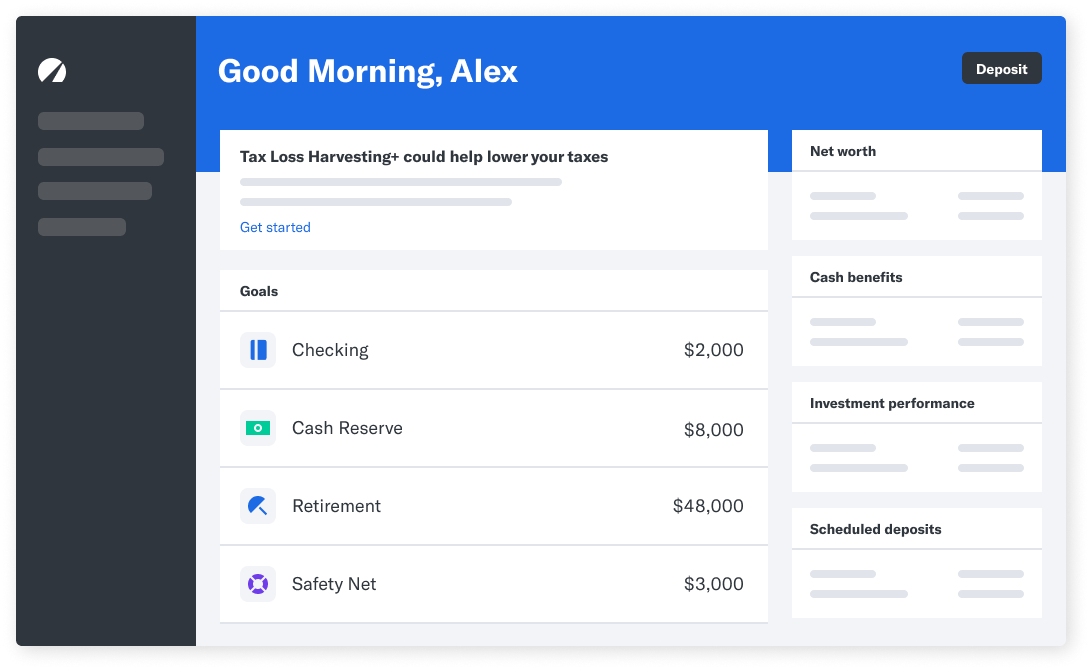

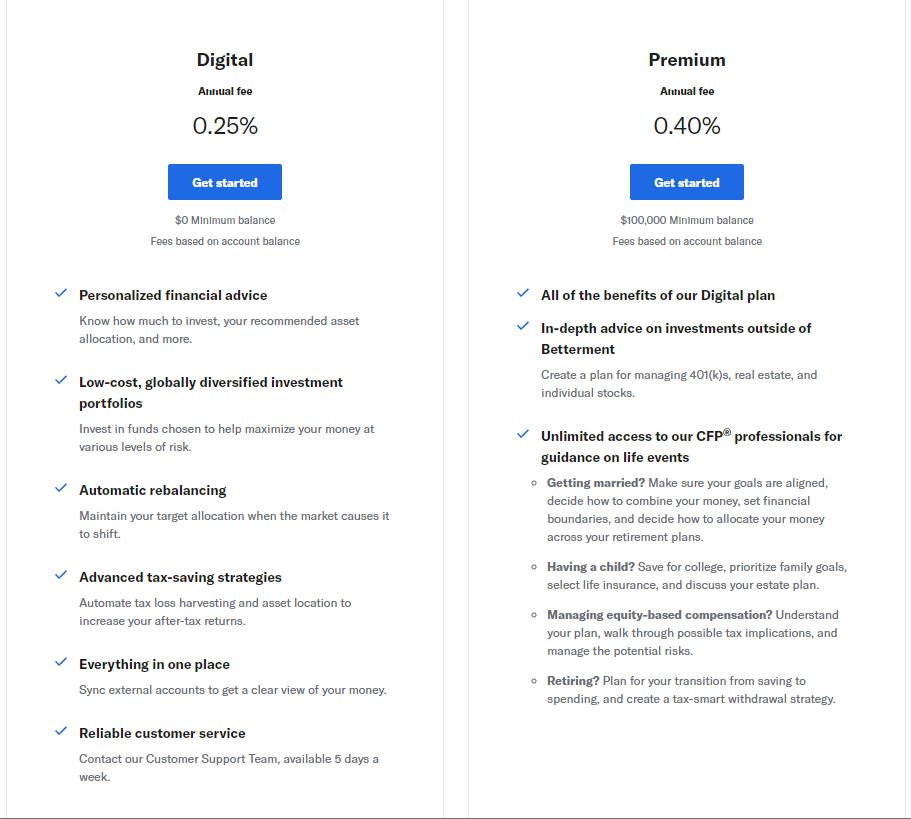

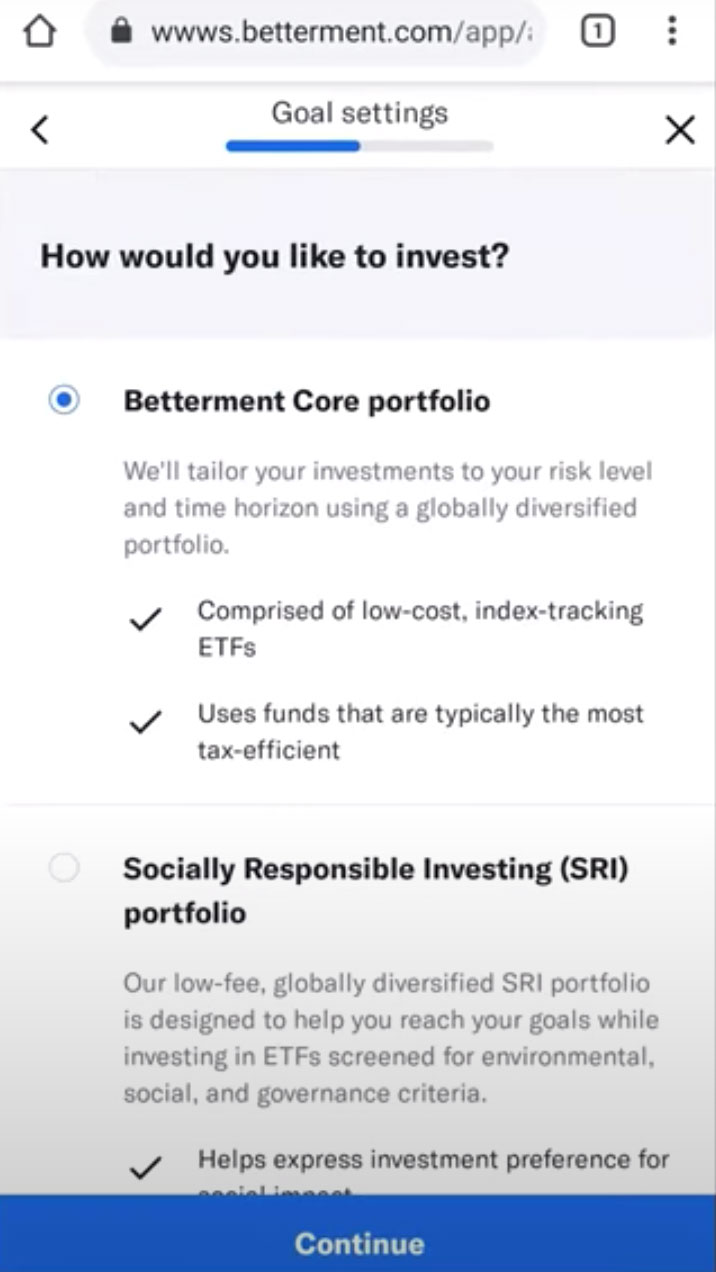

Personal Capital With a minimum. If you make more than a. The Digital level does not require a minimum balance and costs a 025 percent annual fee.

Offset taxes on realized capital gains. You choose to do a withdrawal on 10152021 which generates a 3000 long-term loss. For instance if an investment was originally purchased for 20000 but is now down to 14000 a big 30 decline then harvesting the loss generates a 6000 capital loss.

Reduce tax liability by reducing your income. This is the big one. Realized losses on investments can offset gains.

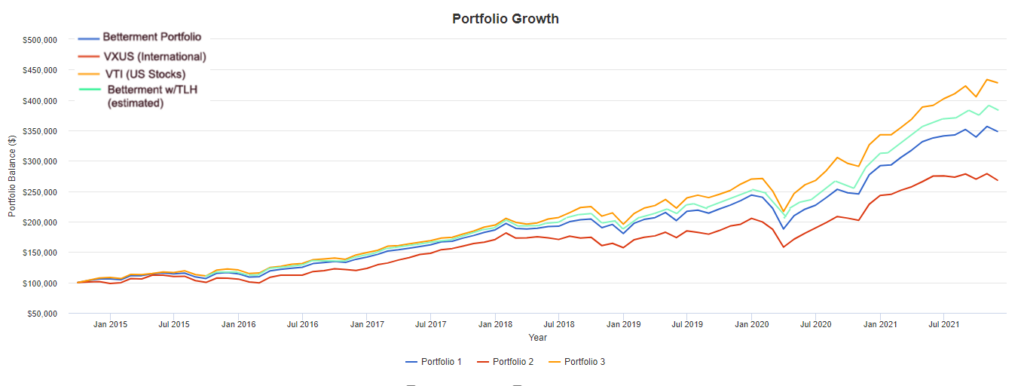

7 rows Some tax loss harvesting methods switch back to the primary ETF after the 30-day wash period. This year we would like to start investing into taxable. Wealthfront figured that it increased annual performance between 073 and 26 from 2012 to 2017 while Betterment estimates that it.

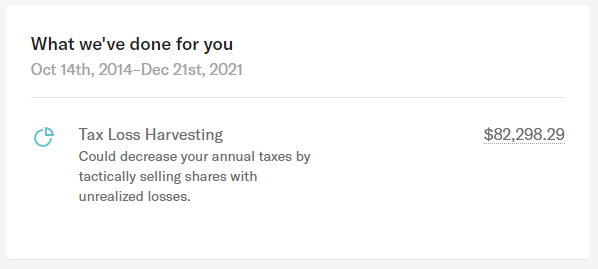

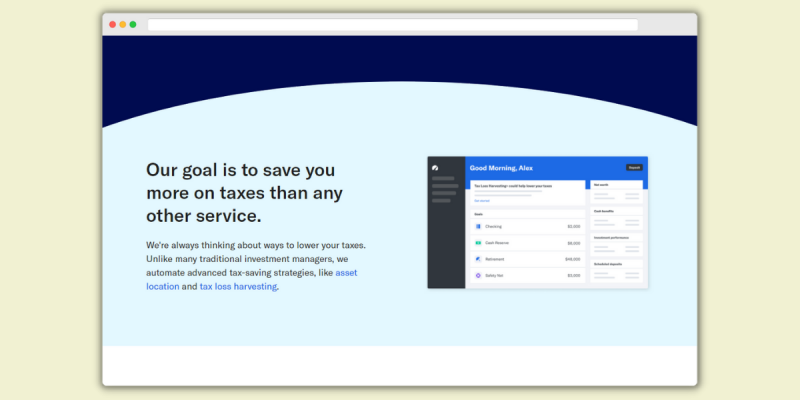

The Form 1099-B will reflect a net long-term loss of 13000. According to Betterment tax-loss harvesting and tax-coordinated portfolio strategies combined can boost investor returns by as much as 266 annually. Sophisticated investors have been harvesting losses manually for decades to acquire tax benefits.

Therefor I am paying 1500 to save 1188 in taxes. Betterment offers a pricing schedule in which the more you invest the smaller your fee for maintaining these investments with the company. Betterment says its portfolios average a svelte 007 percent or 7 per year for every 10000.

By realizing or harvesting a loss you can. Here is the link. But an important variable to this equation is tax-loss harvesting TLH.

That may seem modest but over time it can add up to tens of thousands of. You should carefully read this disclosure and consider your personal circumstances before deciding whether to utilize Betterments Tax Loss Harvesting. The Premium option has a 100000.

Betterment estimates that the additional returns produced by its tax-loss harvesting service will outpace its 025 management fee. If I tax loss harvest at the highest tax bracket 396 the maximum 3000 tax loss harvesting will yield 1188 in tax savings. Losses harvested can be used to offset unavoidable gains in the portfolio or capital gains elsewhere eg from selling real estate deferring the tax owed.

199 for a 45-minute session to discuss your Betterment investments. With just 025 in management fees and tax-loss harvesting Betterment makes it easy to put your portfolio on autopilot. Betterment estimates that its tax-loss harvesting feature boosts after-tax returns about 077 percent per year.

You bring up a good point. My wife and I use Betterment a roboadvisor to manage our IRAs. A robo-advisor such as Betterment would handle all of this for you automatically.

Wealthfront is right there. For Betterment Digital customers this service costs. However lets do the math really to quantify the maximum gains of TLH and compare them to the management fees charged by Betterment.

The Mad FIentist recommends Betterment for the automated tax-loss harvesting. Betterment is not a tax. My 401k is at Fidelity and my wifes 401k is at Schwab.

Betterment and Wealthfront made harvesting losses easier and more. Betterment Tax Loss Harvesting Pricing. Ad Investing Technology Built for Low Fees to Seek Higher Returns Transparency.

In a nutshell you pay less in taxes by holding investments longer. Betterment Tax Loss Harvesting. Robo-advisers tout significant benefits.

Long-term gains are taxed at either 0 15 or 20 depending on your ordinary income tax bracket.

The Betterment Experiment Results Mr Money Mustache

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq

Tax Smart Investing With Betterment

Betterment Review 2022 The Best Robo Advisor One Shot Finance

Betterment Review 2022 How It Works Pros And Cons And My Honest Opinion

The Betterment Experiment Results Mr Money Mustache

Betterment Review 2021 The Leading Digital Wealth Advisor

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq

Betterment Review Is This Robo Advisor Right For You

Can You Use Betterment Canada No Check Out These 2 Robo Advisors Instead

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq

Betterment Review 2022 A Robo Advisor Worth Checking Out

Calculating The True Benefits Of Tax Loss Harvesting Tlh

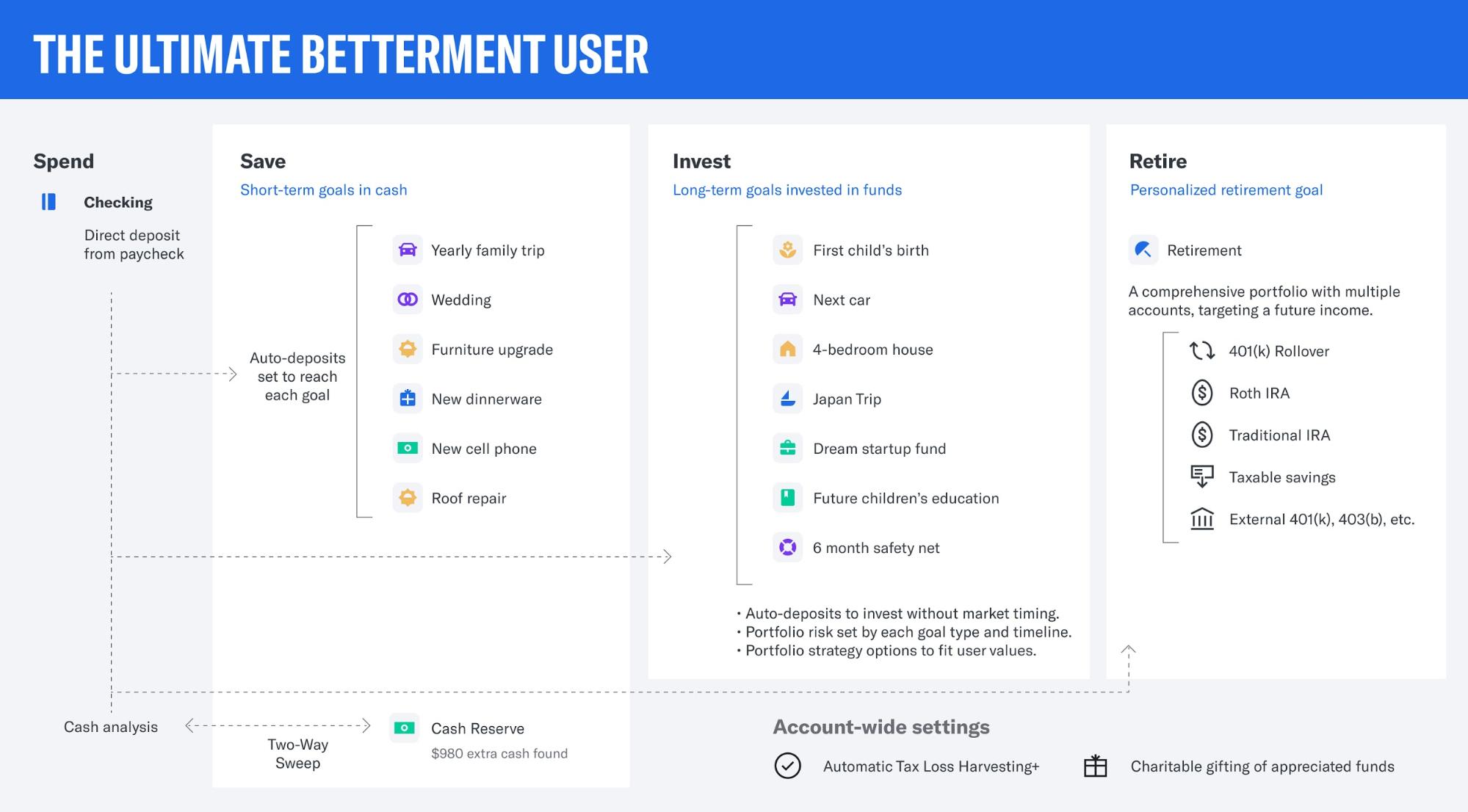

What The Ultimate Betterment User Looks Like

4 Best Robo Advisors In 2022 Out Of 23 Evaluated Robberger Com

Calculating The True Benefits Of Tax Loss Harvesting Tlh

The Definitive Guide To Tax Loss Harvesting And Avoiding Wash Minafi

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq